Personal Contract Purchase (PCP)

What is it?

A Personal Contract Purchase is a flexible form of loan where some of the cost is deferred until the end of the agreement in order to provide you with the benefit of lower monthly payments. The deferred amount is known as the Optional Final Payment and is sometimes also referred to as the Guaranteed Future Value (GFV). At the end of the agreement you have three options:

1. Retain the car: simply pay the Optional Final Payment, and the agreement is complete.

2. Return the car: there’s nothing more to pay if the car is in good condition and within the agreed mileage terms.

3. Renew the car: choose another car, using any excess part exchange value that is above the Optional Final Payment towards your deposit.

How does it work?

You will agree an estimated annual mileage and this will be used to determine the Optional Final Payment

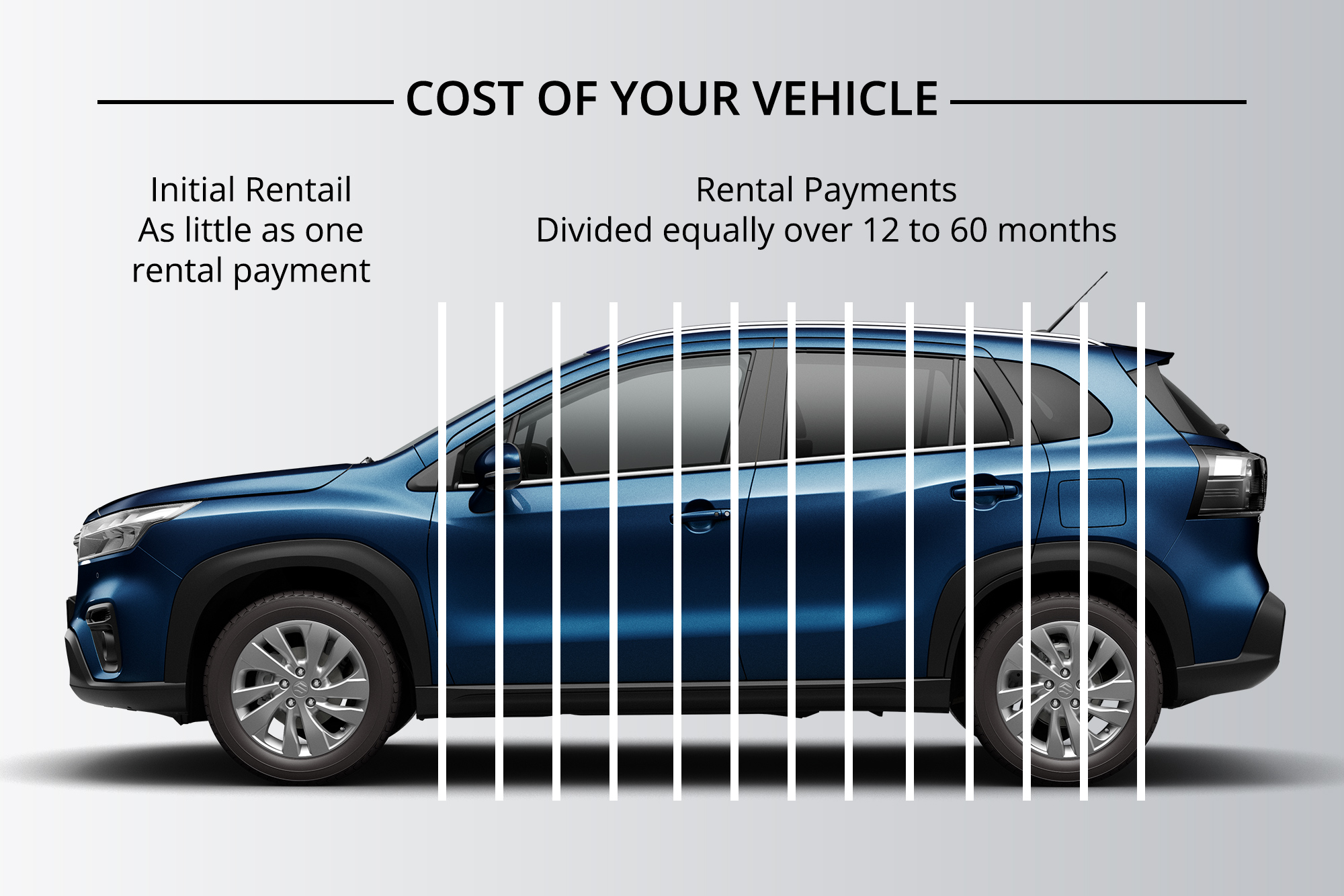

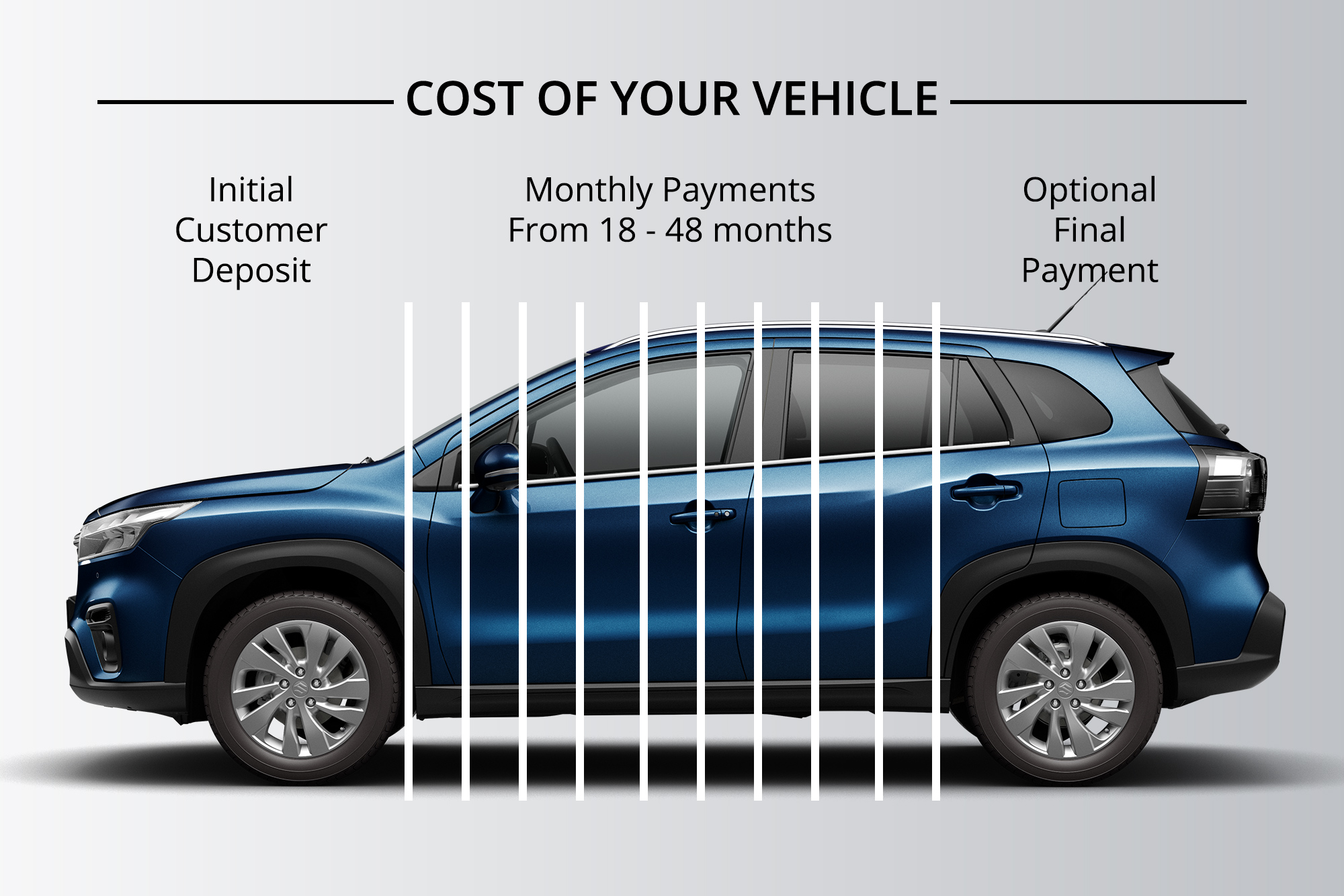

You agree on the amount of deposit, and this figure combined with the agreement duration and Optional Final Payment will determine the amount of your monthly payment

You sign the agreement, pay the deposit and then make the monthly payments

The interest rate is fixed which means you’ll know exactly how much you will repay throughout the term of the agreement

At the end of the agreement we’ll write to remind you of the three available options

You decide which option is best for you. Your dealer may be able to help if you decide to part exchange the car

Features & Benefits

A fixed monthly payment, allowing you to budget with confidence

Potentially lower payments than Purchase Plan agreement

Variety of options available at end of the agreement

You can match the length of your agreement with the time you want to keep the vehicle

You will have the right to terminate the agreement early (under a Voluntary Termination through the Consumer Credit Act 1974)

Important Information

At the end of your agreement you have three options:

- If you fancy a change you can simply part exchange your car for a different make/model on a new Solutions contract

- If you love your car you can pay the option to purchase fee and the optional final payment then take full ownership of the vehicle

- If you don't want to upgrade or keep it, as long as it's been loved, you can simply give it back. (fees may be payable)

It is important that you keep up to date with your monthly repayments, so please contact your lender if you are having any difficulties as the vehicle maybe at risk if you don’t.

You may end your agreement earlier than the full term. However, depending how far you are in to your agreement will affect the final amount left to pay.

If you exceed agreed mileage at the start of your agreement and intend to return the vehicle then excess mileage charges will apply.

Keep the vehicle in good condition as this will affect the value of the vehicle. You may be charged for any damage that goes beyond fair wear and tear.

PCP may not be suitable if you want to settle the agreement early or if want to own the vehicle at the end of the term and may have difficulty in making the balloon payment. Smaller deposits work better with a PCP.